Restructuring Company

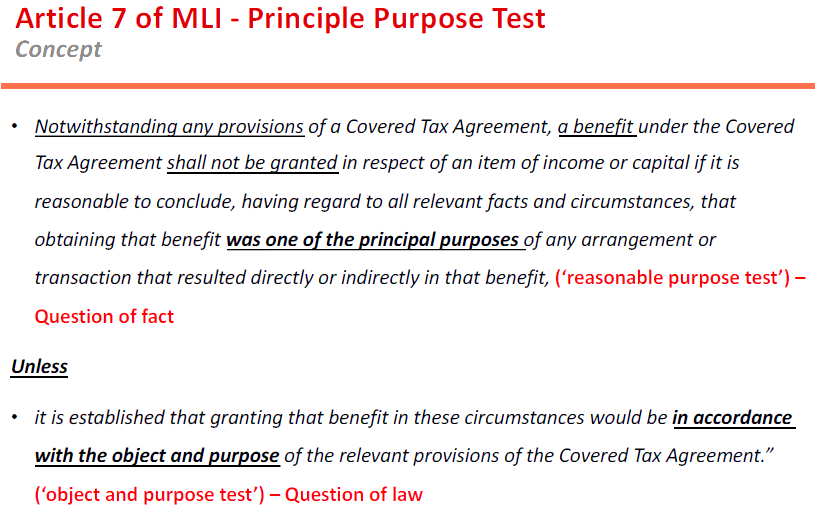

After implementation of Multilateral instrument (MLI) we need to again revisit the Principle Purpose Test (PPT), if PPT test is failed than the treaty benefit can be denied. Hence, we need to do restructuring for entire company group level.

Preamble of MLI suggest that MLI have been implemented as a part of action plan 15 of BEPS/ OECD recommendation without creating an opportunities for non-resident taxation or reduced taxation through tax evasion or avoidance (including through treaty-shopping arrangements aimed at obtaining reliefs provided in those agreement (DTAA) for the indirect benefits of residents of third jurisdictions).

Now we need to do in-dept tax analysis what is covered as per domestic tax laws and how we can mitigate our tax in neutral way. Tax avoidance is permissible under the law since it is not a tax evasion.

We need to do restructuring to fulfil principal purpose test – PPT in order to avoid fear of GAAR and substantiate documentation in such a way to take beneficial provision of tax treaty in the view of MLI impact.

Therefore, even if as per the provisions of the Act if a non-resident is construed to have a BC/ PE in India, the non-resident can still resort to the provisions of relevant DTAA if they are more favourable for him. Article 7 of DTAAs, generally provides that the relevant business profits of non-resident will only be taxable in the source country i.e. India if such non-resident has a PE in India.

In view of the aforesaid, a non-resident who has a BC/PE in India however, does not have a PE in India may avoids his tax liability by simply relying upon the relevant provisions of DTAAs. At this juncture, it pertinent to mention that for claiming benefit under DTAAs, the country in which the non-resident is resident i.e. residence country must have a tax treaty with India and the non-resident must have a tax residency certificate (‘TRC’) from the respective residence country.

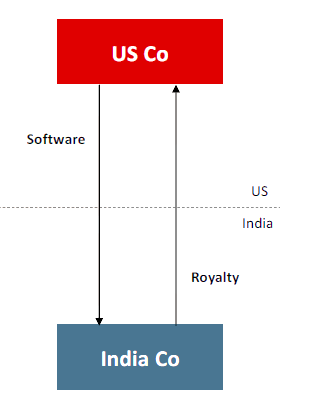

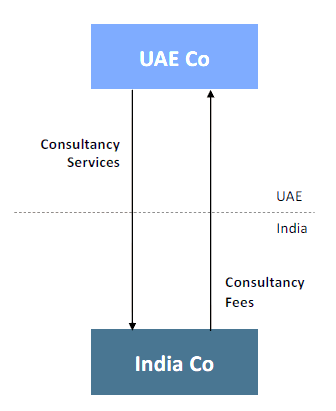

2. Suppose say for example India is paying to its parent company as royalty/ consultancy for which India need to withhold tax source-based tax.

3. In India borrowed capital from parent which is routed through low tax jurisdiction in such a case India has limitation on allowability of interest to the extent of 30% of EBIDA.

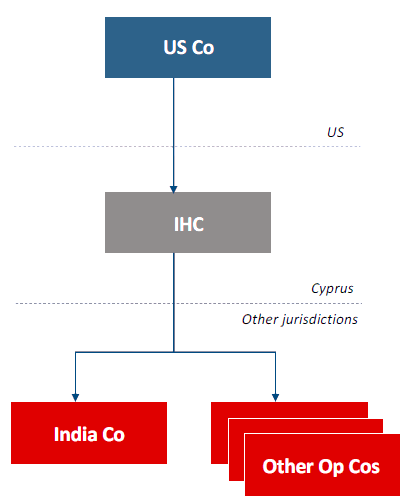

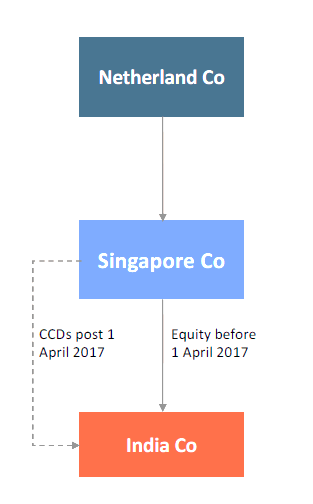

4. Same we can take example of capital invested though the route of use of treaty shopping say for example IHC situated in country where no tax on capital gain on sale of share under article 13 of DTAA. Say e.g. IHC in Singapore or Mauritius, now as per treaty limitation of benefit (LOB) clause has been inserted and amended, accordingly double non-taxation issue have been plugged. However, LOB clause for grandfathering date was 1.4.2017-50% restriction and 1.4.2019-100% taxability.

Hence from the above example it is clear that after implementation of Multilateral instrument (MLI) we need to again revisit the Principle Purpose Test (PPT), if PPT test is failed than treaty benefit will be denied.