Taxation Issues On Digital Economy

Looking from the MNC point of view, tax compliances under different regimes might prove to be burdensome and ultimately lead to reduction of profits specially in case where grossing of equalisation levy is done and the consequent tax burden is borne by payer itself.

Important amendment in Indian domestic law to covering Business connection are as under: -

Explanation 3A, NR E-Commerce operator, Applicable w.e.f. 1.4.2021 AY 22-23

Such income attribution, is now proposed to include income from the following 3 activities viz.:

- income from advertisement that targets Indian customers or

- income from sale of data collected from India or

- income from sale of goods and services using such data collected from India

Explanation 2A, Significant Economic Presence, Applicable for FY 19-20 but not for FY 20-21

India will be open to tax MNCs who interacts with certain number of users in India which may be prescribed either through digital means or not. Nexus for dynamic change widen the scope of Explanation 2A, as earlier phrase ‘carried out by a non-resident in India’ is replaced by ‘carried out by a non-resident with any person in India’.

As of now, this may not have any effect on those MNCs who have double tax avoidance agreement ('DTAA') protection but it is matter of time when India based on its deep consumer base will re-negotiate the DTAA to widen the PE definition to target such MNCs.

Now we need to do in-dept tax analysis what is covered as per law and how we can mitigate our tax in neutral way. We need to do restructuring to fulfil principal purpose test – PPT in order to avoid fear of GAAR and substantiate document in such a way to take beneficial provision of tax treaty alongwith impact of MLI.

Therefore, even if as per the provisions of the Act if a non-resident is construed to have a BC/ PE in India, the non-resident can still resort to the provisions of relevant DTAA if they are more favourable to him. Article 7 of DTAAs, generally provides that the relevant business profits of non-resident will only be taxable in the source country i.e. India if such non-resident has a PE in India.

In view of the aforesaid, a non-resident who has a BC/PE in India however, does not have a PE in India may avoids his tax liability by simply relying upon the relevant provisions of DTAAs. At this juncture, it pertinent to mention that for claiming benefit under DTAAs, the country in which the non-resident is resident i.e. residence country must have a tax treaty with India and the non-resident must have a tax residency certificate (‘TRC’) from the respective residence country.

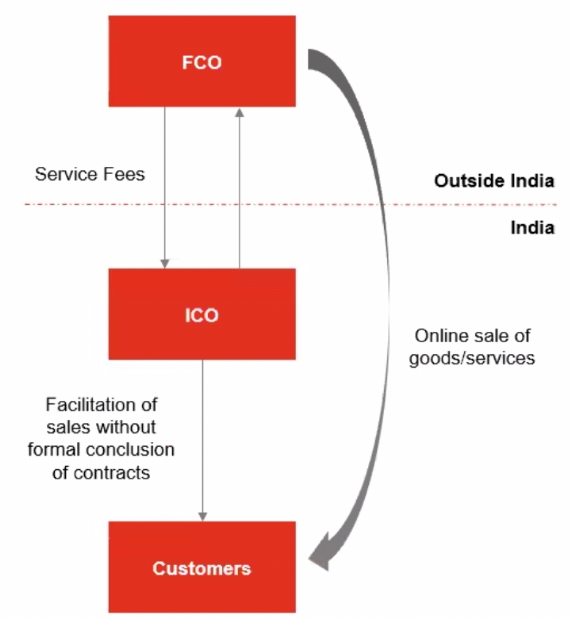

Case Study:

In case of E-commerce company where :-

- FCO. Sell on its online various products and services worldwide. ICO is a related party exclusive working on behalf of FCO.

- Employee of ICO. Send email, make call on the revenue of FCO.

- All online order through the website of ICO. Concluded online with FCO.

- In such scenario exemption for independence and ordinary course of business has been removed for related party. Thus ICO will be PE.