Assisting in Income Tax litigation

No more interactions with tax officials!

I-T Dept goes online with scrutiny work!

CBDT has issued instruction dated 12th February 2018 to conduct assessment proceedings in scrutiny cases electronically, saying that except for search-related assessments, proceedings in other pending scrutiny assessment cases shall be conducted only through the 'E-proceeding' functionality in ITBA/e-filing.

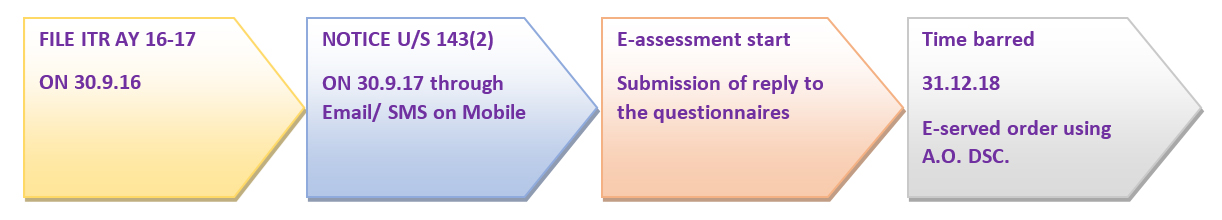

Assessement u/s 143(3)

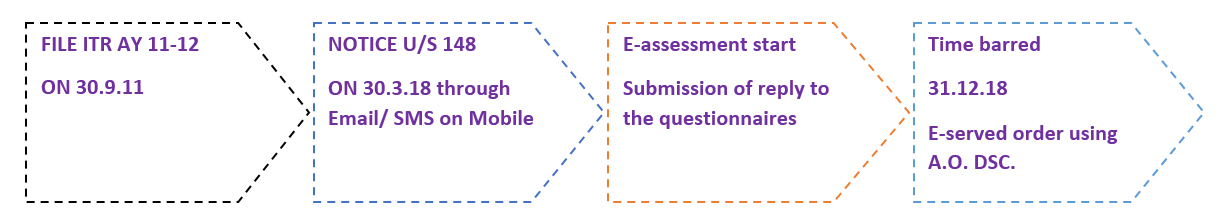

Reassessement u/s 147/ 143(3)

Salient features of ‘E – proceedings’ – As stated in letter dated 23rd June 2017 following are the salient features of e-proceedings

- Income tax department has launched e-proceeding facility to as e-governance initiative to facilitate conduct of assessment proceedings

- Simple way of communication without visits to department

- Taxpayer friendly measure would substantially reduce compliance burden for assessee

- E-proceeding will facilitate seamless flow of communication between AO and assessee

- Assessee would be able to submit the response along with attachments by uploading the same on e-filing portal

- AO would view submissions electronically through Income Tax Business Application (ITBA)

- E – proceeding will save time of assessee as well as department

- Complete information of all e-submissions made will be available on e-filing portal Environment friendly as assessment will be paperless

The Central Government has been clear on one concept – of using technology in every department, and every facet of Governance, and is also clear on another concept – that machine dependency (use of technology) will reduce corruption.

The CBDT initiated on a pilot basis by stating that email shall be used for communicating with the assessee for sending questionnaire, notices, etc., as well as for receiving responses thereto. The Government constituted a Committee to study the feasibility of the recommendations.

The CBDT has now issued an Instruction [No. 01/2018 dated 12th February, 2018] based on which, assessment of all scrutiny cases (except in case of search cases) will be conducted through e-mode only.

If the assessee objects to it, it will, for the time being, be kept on hold.

In para 4.3, it states that “Online submissions may be filed till the office hours on the date stipulated for compliance.” This means that we are still stuck with our traditional approach, which will lead to further litigation as to when it is considered filed, the time in the sent mail or in the received mail. In electronic mode, it should be possible to file 24x7, and accordingly the wordings need to be modified.

Does this mean that all communications have to be sent from the email address of the assessee only?

Does the assessee not have the facility of appointing an authorised representative?

Will the assessee be able to see the order sheet?

Should the assessee not be given a reasonable opportunity to submit the response (as in para 4.4, it states, “electronic submissions through ‘E-Proceeding’ shall be automatically closed seven days before time barring date.”), particularly when the information itself is called for, say, just over seven days before time barring?

Hon’ble Finance Minister Arun Jaitley announce in Budget 18 for e-assessment, from the memorandum to the budget:-

New scheme for scrutiny assessment

Section 143 of the Act provides for the procedure for assessment. Sub-section (3) of the said section empowers the Assessing Officer to make, by an order in writing, an assessment of total income or loss of the assessee, and determine the sum payable by him or refund of any amount due to him on the basis of such assessment.

It is proposed to prescribe a new scheme for the purpose of making assessments so as to impart greater transparency and accountability, by eliminating the interface between the Assessing Officer and the assessee, optimal utilization of the resources, and introduction of team-based assessment. These amendments will take effect from 1st April, 2018.

Accordingly inserted three sub-sections into the Income Tax Act, which will have far reaching implications, though it is in the direction of e-assessment, if it gets converted into law, namely Sections 143(3A), 143(3B) and 143(3C).

“(3A) The Central Government may make a scheme, by notification in the Official Gazette, for the purposes of making assessment of total income or loss of the assessee under sub-section (3) so as to impart greater efficiency, transparency and accountability by––

- eliminating the interface between the Assessing Officer and the assessee in the course of proceedings to the extent technologically feasible;

- optimising utilisation of the resources through economies of scale and functional specialisation;

- introducing a team-based assessment with dynamic jurisdiction.s

(3B) The Central Government may, for the purpose of giving effect to the scheme made under sub-section (3A), by notification in the Official Gazette, direct that any of the provisions of this Act relating to assessment of total income or loss shall not apply or shall apply with such exceptions, modifications and adaptations as may be specified in the notification:

Provided that no direction shall be issued after the 31st day of March 2020.

(3C) Every notification issued under sub-section (3A) and sub-section (3B) shall, as soon as may be after the notification is issued, be laid before each House of Parliament.”

[Emphasis supplied]

The proposed Sub-section (3A) is for making assessment. When one speaks of making assessment of total income, it encompasses almost the entire Income Tax Act, right from definition section to computation sections to assessment procedures, i.e., from Chapter I to Chapter XIV. The purpose stated therein are very vague. For example, sub-clause (a) uses the phrase, “to the extent technologically feasible” which can also mean that the Government is not sure whether it will be possible, or we may land up in the manner we landed in GST, or in the initial stages of online filing of income tax returns.

An even more frightening proposal is the insertion of Sub-section (3B), which will empower the Central Government to state by a notification that any provision of the Act relating to assessment of Total Income (for which one has to travel through various Chapters, right from Chapter I up to Chapter XIV) shall not apply or shall apply with exception, modification and adaption as may be specified. One may hope that the power will not be misused or misinterpreted, but by the stroke of a pen, the Income Tax Act can be bypassed. Does a delegated authority, though Central Government, do this? More litigation is sure to be in the pipeline.

Strong turbulence is in store if such unrestricted power is bestowed upon any authority, particularly with the past experience of lack of follow-up and action thereon, on instructions and circulars already issued by CBDT relating to the assessment procedures. Though e-assessment is good on certain fronts, the Government should come out with clear information as well as data on how this amendment to the Income Tax Act will be put in motion, so as to further smoothen the e-assessment, for which the Department has to first put its own house in order, by training its officers, as a majority of them have forgotten the law they are supposed to implement.

Our Comment:

This new scheme for the purpose of making assessments so as to impart greater transparency and accountability, by eliminating the interface between the AO and the taxpayer, optimal utilisation of the resources, and introduction of team-based assessment. However, there are few issues where clarity is required, e.g. the, term ‘team based assessment' is not defined. Further, a jurisdiction-free assessment implies that a taxpayer residing in one part of a country could be assessed by a tax officer located in another part of the country. These issues may create significant difficulties, and therefore it would be helpful if these issues will be addressed appropriately in the new scheme.