CBCR Reporting

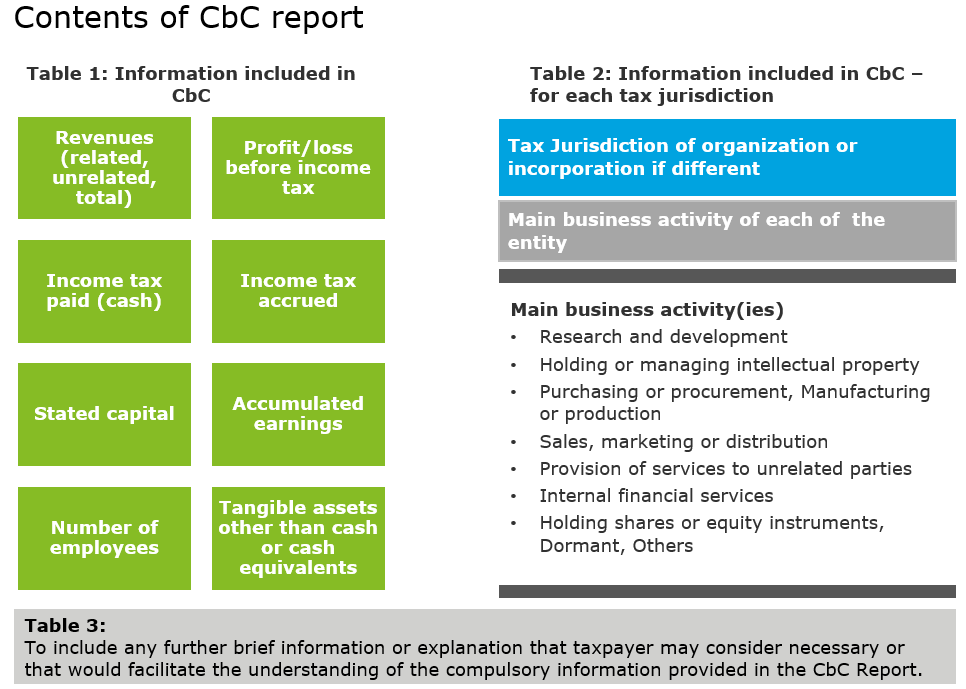

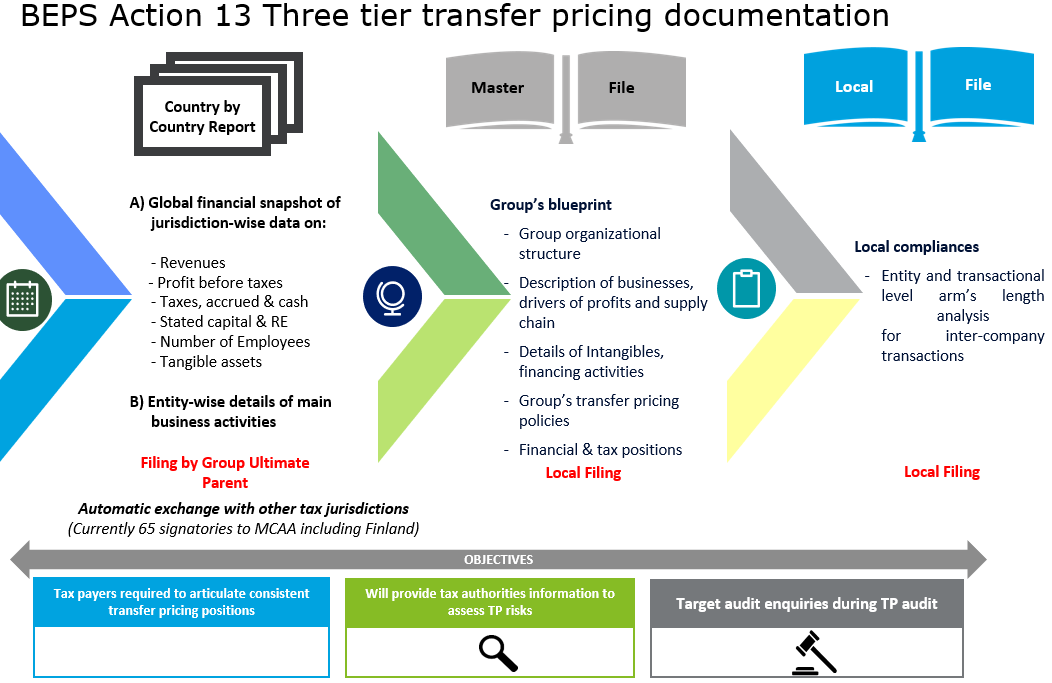

Country by Country Report (CbCR reporting) is part of the OECD’s BEPS Action Plan 13. In essence, large MNCs have to provide the CbC report, that breaks down key elements of the financial statements by jurisdiction. MNCs should file in the country where their most significant activities occurs. CbCR provides tax authorities information to help them assess transfer pricing risks and make determinations on how they allocate tax. In India CbCr reporting required where Group company Turnover exceed € 750 million, To be filed by the ultimate parent entity or the alternate reporting entity in its tax jurisdiction and in India correspondingly required to report the Constituent entities who are filing CBCR.. We can assist in preparing local or Master file to file CBCR report.

- CbC reporting – Implemented in India

-

Timely file CbC report, if it is applicable, where Group Turnover exceed € 750 million (Rs. 5500 crore)

- File within due date of return of income. (ROI)

- Fill by whom : To be filed by the ultimate parent entity or the alternate reporting entity in its tax jurisdiction.

- Constituent entities to notify the details of ultimate parent entity or alternate reporting entity to their local tax jurisdiction.

- Constituent entity

- Whose parent NR -to file Form No. 3CEAC (Intimation)

- Whose parent R -to file Form No. 3CEAD

- Whose multiple CE R -to file Form No. 3CEAE